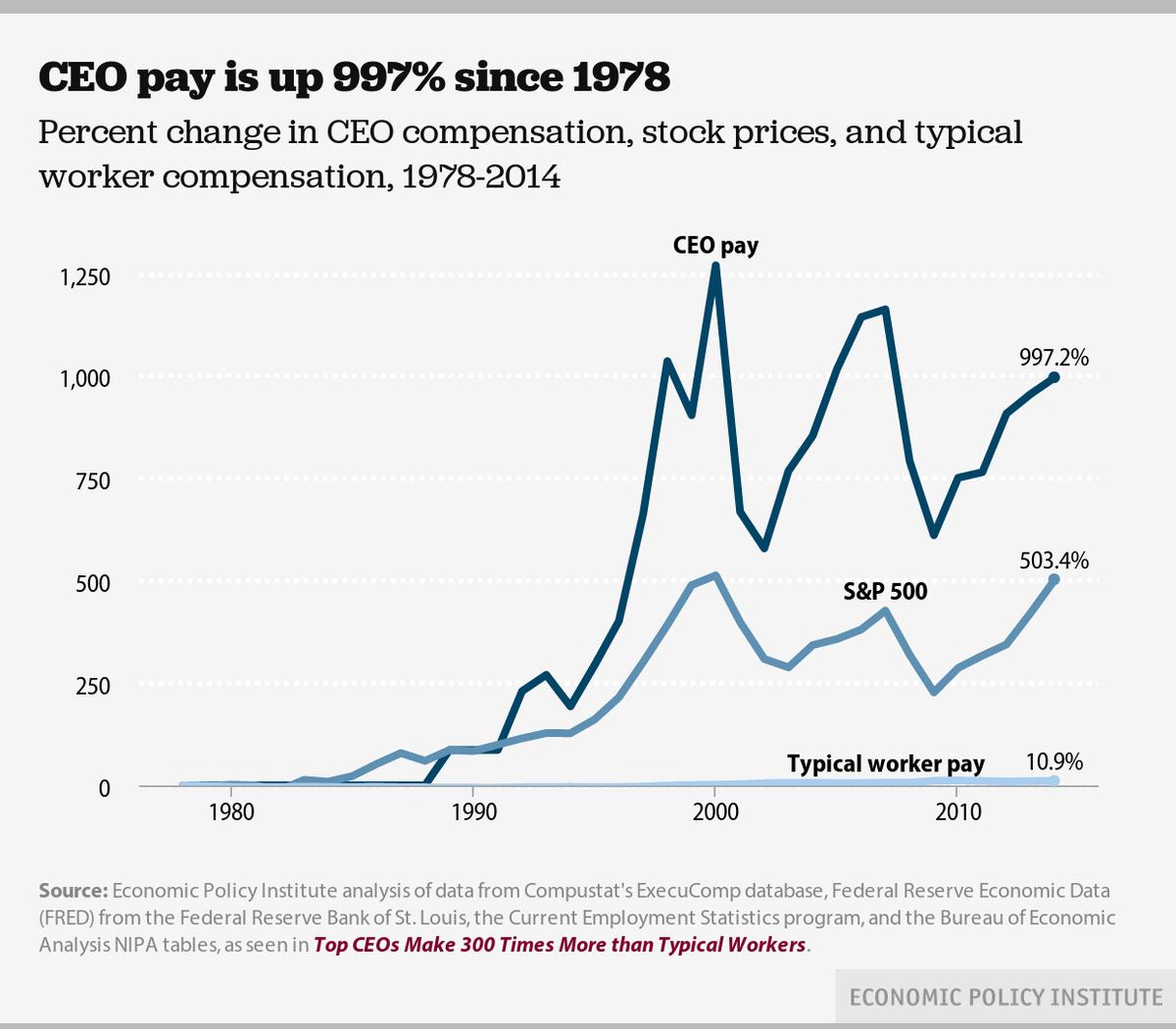

Although corporations are posting record-high profits and the stock market is booming, the wages of most workers remain stagnant, indicating they are not participating equally in prosperity. Meanwhile, CEO compensation continues to rise even faster than the stock market.

In order to curtail the growth of CEO pay, we need to implement higher marginal income tax rates and promote rules such as “say on pay.” At the same time, we need to implement an agenda that promotes broad-based wage growth so typical workers can share more widely in our economic growth.

Methodology

Our measure of CEO pay covers chief executives of the top 350 U.S. firms and includes the value of stock options exercised in a given year plus salary, bonuses, restricted stock grants, and long-term incentive payouts. Full methodological details can be found in Methodology for Measuring CEO Compensation and the Ratio of CEO-to-Worker Compensation, 2012 Update.